“I can’t afford to buy a home.”

“The interest rates are too high.”

“We’re entering a recession.”

There may be some truth to these claims, or maybe these ideas have been percolating our culture long enough to integrate into our belief system. Regardless of where they came from or how long they have been here, these are some home-buying myths that I hear and my plan is to go deep today and pull you out of this cloud of deception.

——————————————————————————————————

Myth #2 -It’s Cheaper to Rent than to Own

Known for its tech industry and stunning natural beauty, the Emerald City is bustling with recent growth. If you’re considering living in Seattle, you’re probably familiar with the age-old debate of renting vs buying. In Seattle’s unique real estate market, both options have their advantages which can make finding your perfect home a challenge.

Right out of the park, I will tell you the one advantage that renting has over buying. This is flexibility. Until you decide where you want to commit or establish roots, renting a home might be a practical choice. But once you establish where you would like to plant those seeds and if you can afford the upfront costs of buying a home, taking on a mortgage in exchange for the potential growth in equity could have long term benefits.

Let’s be honest, in the vast majority of the country, a new monthly mortgage payment is currently out-pricing the cost of paying rent. Home prices across the nation rose by double-digit percentages during the pandemic, and now new home buyers are facing another hit to their wallets because of the surge in interest rates. The typical rate for a 30-year loan topped 8% last month, which means it’s now more than twice as expensive to finance a home purchase compared with 2021 and early 2022, when rates were hovering around 3%. But, while housing costs climb to a record high, renters are not immune from these effects. Inflation impacts the cost of rent as well as interest rates. It’s crucial to take a closer look at the renting vs buying question to reveal just how complicated this decision can be.

When comparing the affordability of renting with home ownership, most people tend to place their focus on the monthly payment. While it’s true that in the immediate, renting is cheaper, the long-term advantage of buying a home would be the fixed payment amount. When you take on a mortgage, you are locking in on a rate for 30 years. While your payment stays the same, your renting counterparts are subject to continuous rent hikes that could be substantial. According to The Seattle Times, the average rent in downtown Seattle increased by 19% between 2017 and 2023. Inflation has brought on high interest rates which cut deeply into the purchasing power of home buyers, but it has also had the effect of causing an increase of rental prices. Ironically, the only people who are somewhat protected from the effects of inflation are existing homeowners who have locked into lower interest rates and the resulting lower monthly mortgage payments.

One might say, “If you are renting, your interest rate is 100%.” Renting is a normal part of everyday life, but it isn’t seen by many as a long-term solution since you actually don’t own the place you’re living in—and you’re essentially missing out on building equity.

And equity is the key to wealth. Home equity is how much of your home that you actually own. For example, if a homeowner has a mortgage balance of $200,000 on a property worth $300,000, their home equity would be $100,000. So, as you pay off your mortgage, you’ll also build equity. This equity can be used as collateral for loans, such as a home equity loan or line of credit, or it can be sold in the form of a “cash-out” refinance to generate cash for other purposes.

Thanks to sky-high housing prices, homeowners are now sitting on nearly $30 trillion in home equity. This is, according to the St. Louis Federal Reserve, just shy of the 2022 peak. That equates to roughly $200,000 cash per homeowner. Until last year, taking cash out by refinancing was a popular way to access the equity you’ve accumulated in your home. This home equity line of credit, otherwise known as a HELOC, lets you borrow money against a portion of your home’s equity. Instead of taking out a home loan at a fixed amount, a HELOC is a revolving line of credit, but with better rates than a credit card, that you can use when you want to, or just to have on hand. But with mortgage rates currently over 7%, that option has become less appealing. Even so, despite the high rates of home equity, borrowers are more likely to take out a second loan to pull cash out, rather than lose their low mortgage rate through a cash-out refi.

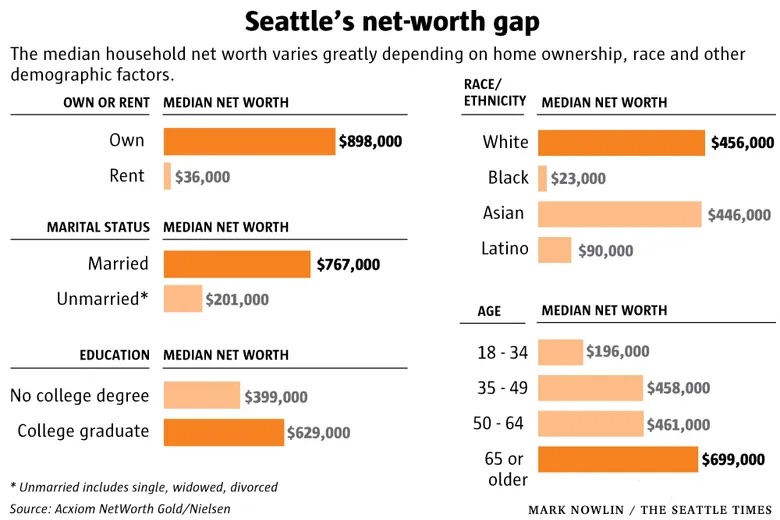

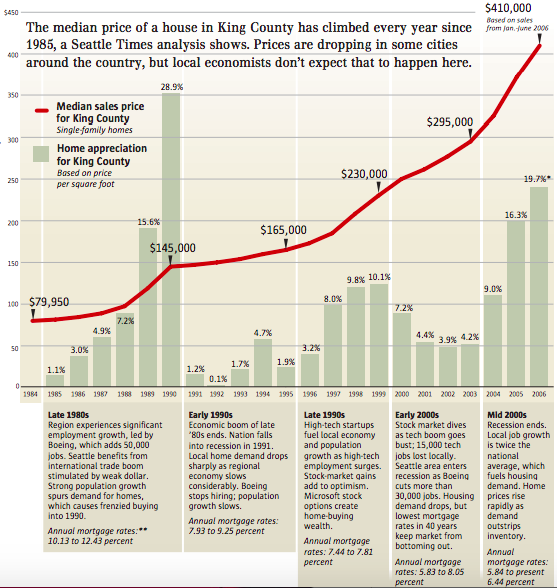

Building equity is playing the long game. As far back as 1985, Seattle has had consistent year-over-year housing price increases, only encountering a hiccup during the 2007 housing crisis. This chart published by the Seattle Times on September 3, 2006 shows the climbing median single-family home prices in King County, ranging from $79,950 in 1985 to $410,000 in 2006. According to Windermere Stats, in October 2023, the median sale price for a home in Seattle was $900,000.

And as the old saying goes, “Marry the house, but date the rate.”

“‘Marrying the house’ means that you should focus more on finding the right property rather than trying to time your purchase to get the lowest interest rate,” says Adam Fuller, a senior loan officer at Mortgage 1 in Grand Rapids, MI. “‘Dating the rate’ means you are not committed to your mortgage loan for life—as long as you can refinance it down the road.”

In an ideal world, home prices will continue their steady modest climb, and interest rates will fall to a comfortable level. If/when this happens, refinancing your mortgage may be a good idea. For insight into how rates rise and fall, take a look at Freddie Mac’s historical mortgage rates data.

We may not be able to predict the future, but there is one thing we do know for sure: change is inevitable. While the current market conditions will not stay the same, home prices will continue to trend upward over time and homeowners will always have the opportunity to build more equity than renters.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link